35 million IRS backlog, July 2021 Update: Tax Return Refund Delays by the IRS.See more details about IRS 20 tax refund delays and backlogs that may affect your 2022 Refund.The return includes Form 8379 - Injured Spouse Allocation.Īdditional delay factors could be due to tax return processing backlogs created during the 2020 Tax Season:.Tax returns that claimed the Earned Income Tax Credit or Additional Child Tax Credit (the IRS holds these returns longer by law for identification purposes).Adjustment or correction to a tax credit, deduction, or other information on your return.

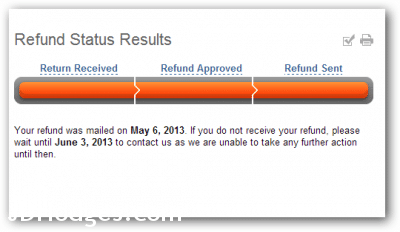

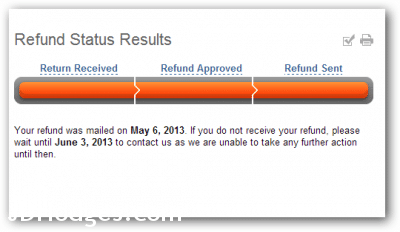

A manual tax return review by the IRS due to potential errors, data omission, identity theft or fraud, etc. Lower Tax Refund Amount or Delay in Refundīelow are potential reasons or different factors why the tax return process could be delayed at the IRS: Select respective state(s) for contact information. Step 4: If your state tax return(s) has been accepted, select this link: Where is my state tax refund? The progression bar for your tax return might vary on what is shown below: Once you have passed the page on top, you will see this message shown below. If your status shows that your information entered was incorrect when you are certain you have entered the right data, this may be due to these delays, meaning they do not have record of the data or refund amount you entered in their system yet and thus cannot display the information. Many taxpayers have experienced slower than anticipated IRS tax refund processing speed or time in 2021, 2022, and 2023. You might see this message after you have entered your data. Step 3: After you have checked your bank account and/or the e-collect lookup tool and your refund has not been deposited, use this lookup tool: Where is my tax refund? Step 2: If your IRS return has been accepted and you selected direct bank deposit, check your bank account first to see if your refund was deposited. Only if your return has been accepted can you check where your tax refund or tax money is.

Sign in to your account and you will see the status of your return(s) on the right side page: Step 1: For users only: You need to verify that the IRS and/or state have accepted your return before you check where your tax refund money is.

Step 1 is for users only all others start at Step 2. To check the status of your federal or state refund, follow the steps below.

0 kommentar(er)

0 kommentar(er)